Click here jump to Action Items.

The precautions necessary because of the COVID-19 crisis are destabilizing the participation of women in the workforce and the financial stability of working families for many years to come. We need permanent changes to help bring prosperity to every family and to grow the productivity of Maryland’s economy. These changes must include lower property taxes; a simpler, more beneficial earned income tax credit; universal pre-K starting at age 3; and an increased minimum wage that is pegged to inflation.

Being a working mom with a three-year old has taught me that, aside from greatly improved schools, what any family needs most is more money and more time. Because we also need more time, the “more money” needs to come from increasing the value of what we already have or do—not from just doing more, which would eat away at our time.

Simplify, expand, and pay out monthly, in advance the Earned Income Tax Credit.

Research shows that an expanded earned income tax credit helps families make ends meet, keeps families working and children out of poverty, and increases family stability.

Maryland has done a great job at expanding the Earned Income Tax Credit, but we can do more, especially in the wake of the COVID-19 crisis. The current system is still too confusing. There should be just one fully refundable credit that is 100% of the federal credit—not a choice between a nonrefundable credit and a fully refundable credit at different amounts.

President Biden has shown us how paying out these these types of credits in advance can be transformational for ending poverty. Maryland’s EITC should be paid out monthly, in advance similar to the Child Tax Credit. Given the early data on the Child Tax Credit, this should be a no-brainer.

The time for a Baby Stocks & Bonds is now.

Baby Stocks & Bonds should be a no brainer in a state with the highest per household income of any state—and second only to D.C. Maryland’s high average wealth masks deep pockets of poverty from the streets of Baltimore, to our rural farmlands and to the eastern shore.

Regardless of family income or dynamics, every child in our state should have a baseline from which to live a prosperous and productive life.

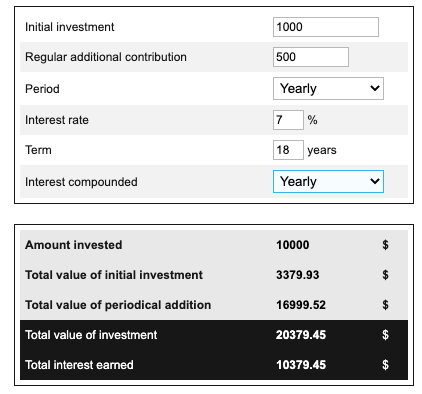

I fully support ensuring that each one of the 71,000 children born in Maryland begins life with an investment valuing $1000.00. After this seed investment, the State of Maryland would make additional annual deposits into the child’s investment account based on a family’s income. Families could make investments too. The poorest families, or those earning below the federal poverty line, would receive a $500 annual investment until the child turns 18, while families with incomes above that would get smaller amounts each year.

Assuming a seed investment based on an S&P 500 index, bearing an average interest rate of 7%, a child could have up to $20,379.45 for buying a home, starting a business, or further education by the time the child turns 18.

In Maryland, wealth must be for more than just the wealthy for our state to continue to grow and thrive.

Slash property taxes.

Even though the city sets its own tax rate, it matters that state delegates advocate for slashing and capping property taxes— a transformational change that would benefit working moms and families whether they rent or own.

In September 2020, I spoke with a single mom who works two jobs and runs a side business for extra income. Her dream is to pay for college for her 16 year old daughter. She saves the money from her extra jobs for her daughter’s college education. She is lucky enough to own her own home as a single mom. But if her property taxes were lower, the monthly savings and increased value in her home (because high property taxes suppress home values), would allow her to let go one job, spend more time with family and still reach her goal.

In October 2020, I spoke with a city worker whose family had looked to buy a house in Baltimore City. He could not afford to purchase in many neighborhoods because the monthly property tax payment placed those homes out of reach for him and his wife. If the property tax rate were half of what they were, they would have been able to buy a house and raise their children in one of those neighborhoods.

The high property taxes mean that single parents are struggling to qualify for home ownership. Parents who already own a home, don’t have the extra income they need to keep up with maintenance on their homes. And with a property tax structure, whole communities are overlooked for any investment or amenities because the long-term value of the house is always worth less than the long-term cost of the property tax.

Meanwhile developers in wealthier neighborhoods are getting property tax breaks and other subsidies to make their effective property tax rates and overall costs competitive with what those costs would be in Baltimore County and DC. In fact, in every other county in Maryland and in DC, the long-term value of the house is worth more than the long-term cost of the property tax.

Baltimore City’s property tax burden is bleeding families—those of us who can least afford it. As your delegate, I intend to spend every breath fighting for and applying state resources to incentivize this change at the city level.

We can absolutely afford to lower property taxes.

Reliable economic models—from our fellow democrat economists—show that we can successfully slash the property tax rate by 61% to $0.86 per $100.00 to be competitive with Baltimore County and DC. If we do so and fix it at that level through a charter amendment, massive investment would flow into the city, just as it did for Boston and San Francisco when they did the same to turn their economies around.

We must introduce a charter amendment or pass legislation now to automatically lower Baltimore City’s property taxes in three years. Limit budget increases to 1%. Save new revenues from new investment in a special fund. Sell assets from Baltimore City’s $4.4 billion real estate portfolio to make up any difference for revenue shortfalls Baltimore would need to sell only half a billion to support this transition.

Developers would still get the breaks they need, but most importantly, ordinary residents and small businesses would too. Working class moms and families could become home owners and those who already own homes, would better afford to maintain what they have, pay for child care, or make new investments in the city or in themselves.

Action Items:

- Action Item #1: Establish a Baby Investment program that will place $1000 in an investment account for every child born in the State of Maryland. Additional deposits up to $500 would be made on a sliding scale based on family income.

- Action Item #2: Expand and simplify the Earned Income Tax Credit so that it is one fully refundable credit up to 100% of the federal credit.

- Action Item #3: Pay out the Earned Income Tax Credit monthly and in advance, similar to the Child Tax Credit.

- Action Item #4: Expand universal pre-K to age 3.

- Action Item #5: The state increased the minimum wage to $15.00 over a six-year period, but the annual rate still needs to be pegged to inflation. Otherwise, we haven’t made meaningful progress.

- Action Item #6: Slash property taxes to make home ownership achievable and sustainable.

- Action Item #7:

The expanded child tax credit has shown us the future for reducing child poverty and improving outcomes for Maryland citizens. With the loss of that federal expanded child tax credit, Maryland should and must step in to fill the gaps where it can. Maryland’s EITC benefit should match fully the federal EITC benefit and it should be paid out monthly. I also support expanding Maryland’s child tax benefit and paying that out monthly too.

The monthly payments are key. Research and our 2021 experience show that anyone receiving this benefit will have better health, higher lifetime earnings, and better high school graduation and college attendance rates. Even babies will have better brain development. Maryland is richer when its people are, making this policy a no-brainer. And we can afford it.